Tuesday, November 6, 2012

Everything you wanted to know about bookstores in America

Did you know for example that currently we have 10.800 bookstores in total in the U.S., a 12.2 percent drop in comparison to 1997? And what about Amazon - what's their share in the market? Well, apparently it's around 22.6% of the books in the U.S.(2011 figures).

An interesting fact that I've learned about in this article was that the average book buyer is 45 to 64, white, has a high income, is married, lives in the west, and is a college graduate. I guess it shouldn't be a surprise then to see the increase in Amazon's market share and the decrease in the total number of stores - the younger generations are just looking for other places to buy their books and e-books.

Yet, the list ends with an optimistic forecast - independent bookstores may be making a comeback. It might be too soon to know if it's true, but it's certainly an optimistic way to close this great list of facts and we definitely hope it will come true!

You can find more resources on the future of bookstores on our website at www.ecolibris.net/bookstores_future.asp

Yours,

Raz @ Eco-Libris

Eco-Libris: Promoting sustainable reading!

Wednesday, September 5, 2012

Jonathan Demme interviews Author Daniel Wolff and more interesting events at Strand this month!

Our friends at Strand Bookstore have not only great books, but also great events all year round. This month is no different with a list that includes, Artist Robert Longo and Novelist Richard Price In Conversation, Director, Actress, Producer Penny Marshall Chats & Signs Her New Memoir and Joyce Johnson’s New Portrait of Jack Kerouac, with Journalist John Leland.

There's one event I especially want to recommend on: Filmmaker Jonathan Demme will interview author Daniel Wolff on September 18, 7-8pm.

Here are some more details from Strand's website on this upcoming interesting event:

Writer Daniel Wolff’s books include How Lincoln Learned to Read, and You Send Me: The Life of Sam Cooke. Daniel was researching for the documentary I am Carolyn Parker, which he was producing with filmmaker Jonathan Demme, when his new book, The Fight For Home: How (part of ) New Orleans Came Back, was born. The story looks at a range of locals who not only survived the floods, but also have dealt and continue to deal with the deep corruption and poverty that affects the city.

Academy Award winning director Jonathan Demme has made countless films and documentaries including The Silence of the Lambs, Philadelphia and Stop Making Sense.

Buy The Fight for Home or a $10 Strand gift card in order to attend this event. Both options admit one person. Please note that online orders require payment at the time of checkout to guarantee admission. The event will be located in the Strand's 3rd floor Rare Book Room at our store at 828 Broadway at 12th Street.Additional copies of the book (and previous books by the author, when applicable) will be available for purchase at the event.

Located in 828 Broadway (at 12th St.), this New York's independent landmark bookstore is one of most famous bookstores in the world. With over 200 employees, more than 2.5 million used, new and rare books, a renovated main store and a growing author events program, the Strand looks forward to offering great books at great prices to book-lovers worldwide for another 80 years.

For more information on September's events please check Strand's list of events at http://www.strandbooks.com/events/.

Strand bookstore is also a partner of Eco-Libris. Strand are taking part in our bookstore program and customers at the store can plant a tree for every book they buy there and receive our sticker at the counter!

Raz @ Eco-Libris

Eco-Libris: Promoting sustainable reading!

Friday, August 24, 2012

DUMBO's powerHouse will be openning a new store in Park Slope, Brooklyn

Good news from Brooklyn! The Brooklyn Paper reported earlier today that "DUMBO’s powerHouse Books is planning to open an outpost in a former video rental shop on Eighth Avenue in October — marking the first high-profile bookstore to come to the neighborhood since Barnes and Noble set up shop on Seventh Avenue in 1997."

This is certainly a bold move, as even Park Slope doesn't seem to be immune to the unfortunate trend of bookstore closings - the neighborhood once had four booksellers on Seventh Avenue alone, but now has just two.

There might be a reason yet to be optimistic, as Ezra Goldstein, co-owner of the Community Bookstore on Seventh Avenue, offers a more positive perspective on the state of bookstores in Park Slope:

“Our business is way up despite Nooks, Kindles, and Amazon. We now share that literary cachet with many more neighborhoods, but people in Park Slope still love books.”

Will that be good enough to justify the opening of another bookstore? powerHouse hopes so and so do we!

The bookstore is expected to be opened on October and will be located at 1111 Eighth Ave. between 11th and 12th streets in Park Slope. Check www.powerhouseon8th.com for further updates.

Yours,

Raz @ Eco-Libris

Eco-Libris: Plant trees for your books!

Wednesday, March 21, 2012

A children’s bookstore is looking for funding on Kickstarter

GalleyCat reported last week on an interesting funding effort on Kickstarter - this time it's a children's bookstore. According to the report, children’s books illustrator Richard Christie is looking to raise $22,750 on Kickstarter to makeover his children’s bookstore, Gas-Art Gifts. The term “gas” is an acronym for “Gregarious Art Statements.”

GalleyCat reported last week on an interesting funding effort on Kickstarter - this time it's a children's bookstore. According to the report, children’s books illustrator Richard Christie is looking to raise $22,750 on Kickstarter to makeover his children’s bookstore, Gas-Art Gifts. The term “gas” is an acronym for “Gregarious Art Statements.”So far Richard has $3,470 in pledges from 61 backers with 10 more days to go. It means that he still needs to raise $19,280 to meet his goal, or he won't receive any of this money. Here's a further description of his project followed by the video he put on Kickstarter:

We come to kickstarter because this children's and young teens' book store, needs a new look. this is an opportunity for you to make children's literacy as valued as the newest pair of sneakers. We desire a trendy looking store that puts literature along with tangible- handmade art on sleek pedestals and modern shelves.

With your support we can bring a passion for history and culture to teens and parents who may have never thought about these things.

The store will feature autographed children's books and handmade products at a reasonable price. Additionally the mall's management is fine with bringing in creative friends to do weekend long intensive workshops. It would be a fulfillment of a dream for us to teach the community to stop buying back their own culture from corporations. Most of the expensive items they wait in a line for, can easily be made or personalized with their own creativity. I miss the days when kids would buy a brand, then paint it, tear it, sew it and redesign it in to their own expression.

Workshops teaching book-binding,painting,t-shirt production,silk screening, even computer and cell phone cover design painting will be offered. I will have something to teach any aspiring art student or curious craft enthusiast.

You can check it out at http://www.kickstarter.com/projects/1052202997/a-childrens-book-store-makeover

Yours,

Raz @ Eco-Libris

Eco-Libris: Plant trees for your books!

Sunday, January 29, 2012

Why the question now is when and not if Barnes and Noble will file for bankruptcy

In the last couple of years I started thinking B&N might file for bankruptcy because they have no strategy to transform their brick and mortar stores from a liability back to an asset. Now, after reading Julie Bosman's article 'The Bookstore’s Last Stand' on the New York Times, I'm more positive about it than ever.

In the last couple of years I started thinking B&N might file for bankruptcy because they have no strategy to transform their brick and mortar stores from a liability back to an asset. Now, after reading Julie Bosman's article 'The Bookstore’s Last Stand' on the New York Times, I'm more positive about it than ever.Unfortunately after reading this article, I'm afraid the realistic question we need to ask is when B&N will go bankrupt and no if they'll actually do it. Here are five quotes from the article that will explain why:

1. "Mr. Lynch says Barnes & Noble stores will endure. The idea that devices like the Nook, Kindle and Apple iPad will make bookstores obsolete is nonsense, he says." - It's a 3-page article, yet you won't find there a word of explanation from CEO Lynch why its nonsense and how he plans to save his stores.

2. "For all the bells and whistles and high-minded talk, Barnes & Noble doesn’t exactly have the cool factor (or money) of, say, a Google or a Facebook." - Say no more. Do you really believe B&N can out-innovate Amazon and Apple with their very limited resources? I doubt that.

3. "Carolyn Reidy, president and chief executive of Simon & Schuster, says the biggest challenge is to give people a reason to step into Barnes & Noble stores in the first place. “They have figured out how to use the store to sell e-books," she said of the company. "Now, hopefully, we can figure out how to make that go full circle and see how the e-books can sell the print books.”" - She is right and I guess she also knows B&N haven't provided yet any good reason for most readers to step into their stores. I can only wonder if she believes they'll actually find a way to do it.

4. "And yet, in three years, he (William Lynch, CEO, B&N) has won a remarkable number of fans in the upper echelons of the book world. Most publishers in New York can’t say enough good things about him: smart, creative, tech-savvy — the list goes on." - It's definitely great to have a nice guy at the top of the pyramid, but with no answers on how to transform the stores back from a liability to an asset and with little vision on how to keep B&N in business, not to mention relatively poor results, Lynch needs less fans and more people that will tell you what he's doing wrong and how to fix it.

5. "No one expects Barnes & Noble to disappear overnight. The worry is that it might slowly wither as more readers embrace e-books." - two years ago no one in the media would even speculate such a thing. Now it has became a reasonable assumption, which shows you how high the probability that B&N will file for bankruptcy is.

To learn more on our B&N index series visit Barnes and Noble Bankruptcy Index on our website.

You can find more resources on the future of bookstores on our website at www.ecolibris.net/bookstores_future.asp

Yours,

Raz @ Eco-Libris

Eco-Libris: Working to green the book industry!

Thursday, January 5, 2012

5 reasons why the Nook spin off gets B&N closer to bankruptcy

Barnes & Noble announced this morning it is beginning “strategic exploratory work” to separate its rapidly growing Nook digital business. If you follow our blog, you're probably not that surprised - as we reported again and again on the B&N Bankruptcy Index series, B&N behaves for a long time like the Nook is its core business and not its 703 bookstore.

Barnes & Noble announced this morning it is beginning “strategic exploratory work” to separate its rapidly growing Nook digital business. If you follow our blog, you're probably not that surprised - as we reported again and again on the B&N Bankruptcy Index series, B&N behaves for a long time like the Nook is its core business and not its 703 bookstore.So you're probably wondering - would this spin-off will help B&N to avoid bankruptcy? Actually, I believe it only gets them closer to this unfortunate faith. Here's five reasons why:

1. B&N bookstore business is declining and B&N has no clear strategy how to transform it back from a liability to an asset. Frankly, this announcement only demonstrates that B&N is giving up on the brick and mortar stores and putting all its energy and resources just into the Nook. Don't believe me? Just count look how many times B&N mentions its bookstores in its press release from today (hint: less than one).

2. B&N is focusing all of its resources on one egg - the Nook. It's a good egg, but even if it will have a bright future as B&N is expecting it's still too risky, especially in a market where your competitors are are Amazon and Apple.

3. B&N doesn't have the deep pockets Apple and Amazon have. Just look at the balance sheets of these three and compare how much cash each of them has - Amazon has $2.8 billion, Apple has $9.8 billion, while B&N has $23 million in cash and cash equivalents (latest figures available). Now, who do you think has a better chance to develop better tablets and e-readers in the near future?

4. Bad management - B&N would have a much better chance if it would have spun off its management instead of the Nook. Why it's a bad management? How else you can call a management that takes an asset like 700+ bookstores and makes almost zero efforts to save it from bankruptcy?

5. "Mr. Lynch said Barnes & Noble doesn't see itself as a competitor with Apple, as it focuses more on digital reading, but said internal research shows customers prefer the Nook over the Kindle." (Wall Street Journal) I wish I have a faith in a company that this is the worldview that directs its strategy and this is the quality of research data it uses. Unfortunately I really can't.

To learn more on our B&N index series visit Barnes and Noble Bankruptcy Index on our website.

You can find more resources on the future of bookstores on our website at www.ecolibris.net/bookstores_future.asp

Yours,

Raz @ Eco-Libris

Eco-Libris: Working to green the book industry!

Saturday, December 3, 2011

Today is Take Your Child to a Bookstore Day!

Today is Take Your Child to a Bookstore Day. GalleyCat reports that founded by novelist Jenny Milchman, the new tradition urges parents to pass along the joy of bookstore shopping to the next generation. What a great idea a great idea, right?

Today is Take Your Child to a Bookstore Day. GalleyCat reports that founded by novelist Jenny Milchman, the new tradition urges parents to pass along the joy of bookstore shopping to the next generation. What a great idea a great idea, right?Here are more details about this day from Take Your Child to a Bookstore Day's website:

Take Your Child to a Bookstore Day began when my children were little and I was going to story time at bookstores nearly every week. Did all children know the pleasure of spending time in a bookstore? I wondered. Of being drawn into a magic world for a while, then being left to choose treasures on the shelf? I wanted to begin a holiday that would expose as many kids as possible to this joy.

But Take Your Child to a Bookstore Day quickly became bigger than one mother and her children. Bloggers and book lovers took it viral across the web, carried posters into bookstores, and welcomed me and my family to local bookstores when we traveled cross country last summer.

Now we are busily adding stores, helping support celebrations on the Day, and leading people to the wonderful places we have found. In the future, Take Your Child to a Bookstore may offer grants for children who can't visit a bookstore on their own, or perhaps there will be internships for kids who want one day to own a bookstore. Because the sky is the limit when there is a book!

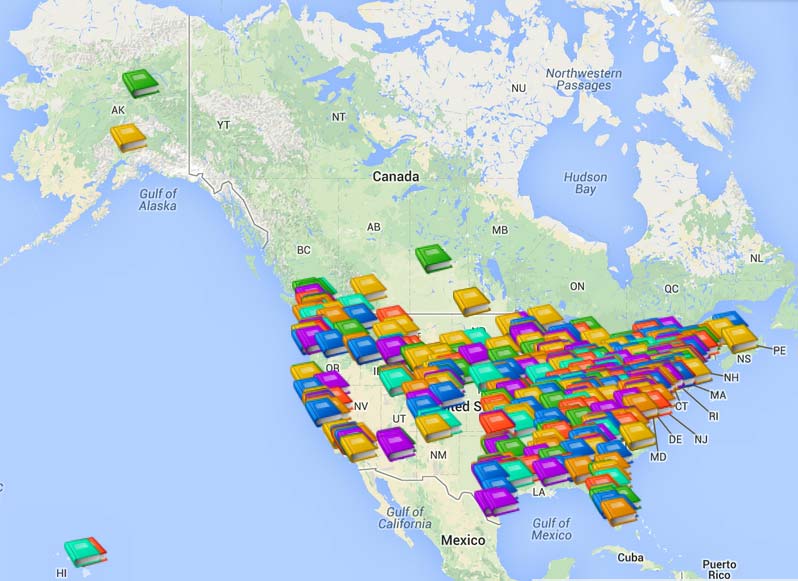

I'm going to take my kid to Strand Bookstore, which is not just a great indie bookstore, but also partners with Eco-Libris to offer customers to plant a tree for every book they buy at Strand. Which bookstore will you go to with your kid to? Have a look at the Day's Bookstores page to see a map of the almost 150 bookstores participating in Take Your Child to a Bookstore Day!

Which bookstore will you go to with your kid to? Have a look at the Day's Bookstores page to see a map of the almost 150 bookstores participating in Take Your Child to a Bookstore Day!For more information visit Take Your Child to a Bookstore Day's website.

Photo credit: Take Your Child to a Bookstore Day's website

Enjoy this day,

Raz @ Eco-Libris

Eco-Libris: Promoting green reading!

Thursday, October 13, 2011

Beetroot Books is collaborating now with Eco-Libris (our first store in the UK!)

We're happy to announce on a new bookstore that is collaborating with Eco-Libris - Beetroot Books, the first bookstore we're working with in the UK!

We're happy to announce on a new bookstore that is collaborating with Eco-Libris - Beetroot Books, the first bookstore we're working with in the UK!This unique online bookstore is joining Eco-Libris bookstores program and will offer the store's customers the opportunity to plant a tree for every book they buy there and receive our "One tree planted for this book" sticker with their new book!

Why buying books with Beetroot Books (besides the fact they're partnering with us)? Here are some convincing reasons that will also help you to get to know them better:

They specialize in titles that enable you to think, act, learn, challenge, enjoy. They’re a one stop shop for everything sustainable, alternative, green and active – for all ages. Also, every one of their books is hand-picked – if you need advice or recommendations about any of our books or subjects we’ll be willing, able and happy to help you.

They stock and promote titles from independent publishers and unpublished writers. They also donate £1 for every gardening book sold to disability charity and £1 for every children’s book sold to child literacy charity Springboard for Children. Last but not least, Beetroot Books is powered 100% by renewable energy.

Bottom line: Beetroot Books is different from corporate stores - While corporate stores care what they sell, Beetroot care on how they sell. they offer you the best prices but won’t exploit in order to do so.

Bottom line: Beetroot Books is different from corporate stores - While corporate stores care what they sell, Beetroot care on how they sell. they offer you the best prices but won’t exploit in order to do so.You can visit them at http://www.beetrootbooks.com/

Yours,

Raz @ Eco-Libris

Eco-Libris: Promoting Sustainable Reading!

Monday, September 12, 2011

Is Books-A-Million going to follow Borders into bankruptcy?

"Net sales for the 13-week period ended July 30, 2011 decreased 11.4% to $106.4 million from net sales of $120.0 million in the year-earlier period. Comparable store sales for the second quarter declined 12.9% compared with the 13-week period in the prior year. Net loss for the second quarter was $2.9 million, or $0.18 per diluted share, compared with net income of $1.9 million, or $0.12 per diluted share, in the year-earlier period.

| 1/3/2011 | 9/9/2011 | Return | |

| Amazon | 184.22 | 211.39 | 14.75% |

| B&N | 15.42 | 11.38 | -26.20% |

| Books-A-Million | 5.86 | 2.6 | -55.63% |

The company in its latest annual report explains that "recent market volatility has exerted downward pressure on our stock price, which may make it more difficult for us to raise additional capital in the future."

Yours,

Raz @ Eco-Libris

Eco-Libris: Plant trees for your books!

Saturday, August 20, 2011

Why John Malone does not want to buy Barnes and Noble?

Bloomberg reported yesterday that "Liberty Media Corp., controlled by billionaire John Malone, invested $204 million in Barnes & Noble Inc. (BKS) after dropping its offer to acquire the largest U.S. bookstore chain"

Bloomberg reported yesterday that "Liberty Media Corp., controlled by billionaire John Malone, invested $204 million in Barnes & Noble Inc. (BKS) after dropping its offer to acquire the largest U.S. bookstore chain"

So why did Malone decide not to buy B&N and purchase only 17 percent of the company's stock (at $17 a share)? Here are few possible answers:

1. He finally understood that B&N has become a risky business operating in a volatile environment.

2. He understands that B&N is still mostly a brick and mortar retailer and as such is very vulnerable to the changes in the book industry, from the rise of e-books to increasing competition from discount retailers such as Wal-Mart (Just a reminder: Comparable store sales at its consumer bookstores fell last quarter 2.9% amid a decline in trade books).

3. He knows that B&N has no winning strategy on how to transform its 700+ stores from a liability into an asset. Apparently he doesn't know it either.

4. He learned the lessons from Borders' bankruptcy and liquidation.

5. All replies are correct.

So why does Malone invest $200 million at B&N? I guess he believes this way he is limiting his risks this way and gives himself a ticket to the world of digital reading, tablets and other future gadgets that will take control of our life in the near future.

On Bloomberg, Bill Kavaler, a New York-based analyst at Oscar Gruss & Son Inc., is quoted saying:

“John Malone likes to buy low-cost calls on interesting potential and ideas and Barnes & Noble is interesting as the only national book chain that’s standing,” Kavaler said. “For $200 million, he’s got a shot at seeing what happens.”

Well, I am not sure if this $200 investment is a cheap bargain. We'll have to see about it. As of today, Friday's stock price of $9.98 results in a $80 million paper loss for Malone.

In any event, there's no doubt this is still a very risky investment - not only because of the stores, but also because on the digital side of the business B&N competes with companies that are more technological oriented and have deeper pockets, such as Amazon and Apple.

We hope Malone won't regret it. We'll keep updating you on it.

You can check our updates on Barnes and Noble Bankruptcy Index on our website.

You can also find more resources on the future of bookstores on our website at www.ecolibris.net/bookstores_future.asp

Yours,

Raz @ Eco-Libris

Eco-Libris: Plant a tree for every book you buy!

Wednesday, July 20, 2011

RIP Borders - The bookstore chain is closing its doors

Now it's official - Borders Group announced on Monday that it will close all of its stores and sell the company to a group of liquidators led by Hilco Merchant Resources. It means that almost 11,000 employees will lose their jobs and the chain's 400 remaining stores will close their doors by the end of September.

Now it's official - Borders Group announced on Monday that it will close all of its stores and sell the company to a group of liquidators led by Hilco Merchant Resources. It means that almost 11,000 employees will lose their jobs and the chain's 400 remaining stores will close their doors by the end of September.This is a very sad day to any book lover, no matter if you're a Borders customer or not. The fact is that this isn't just an isolated case, but an indicator to the change in the industry, where brick and mortar stores can't find an adequate reply to the online competition as well as to the growing demand for ebooks and are losing customers until they can no longer stay in business.

NPR report explained the problem:

"Indeed, outside a Borders bookstore in Arlington, Va., shoppers say they rarely buy books the old-fashioned way."I'll go to Borders to find a book, and then I'll to go to Amazon to buy it, generally," customer Jennifer Geier says. With so many people going online to buy books, Borders lost out. The last time it turned a profit was 2006. "

According to NPR the case of B&N is different, but we believe it's actually no different than Borders, at least in the sense that B&N hasn't find yet the way to transform its brick and mortar stores back into an asset. If they won't find the way to do it, they will be left with BN.com and the Nook, but without stores. They still have time to figure it out, but they need to remember their time is running.

Borders stores will begin closing as early as Friday. The New Yorker gives a good advice to spend your gift cards this week. (Please buy books, rather than calendars, lattes, or Moleskine notebooks.) It adds that liquidation will continue through the summer and is likely to be complete by September.

For more news and updates on Borders post bankruptcy visit our website at http://www.ecolibris.net/borders.asp.

You can also find more resources on the future of bookstores on our website at www.ecolibris.net/bookstores_future.asp

Yours,

Raz@Eco-Libris

Eco-Libris: Planting trees for your books

Friday, July 1, 2011

Finally there's a buyer for Borders - Direct Brands of Najafi will buy Borders for $215 million!

Update from Borders: IB Times reported today that Direct Brands, a portfolio company of Najafi, will purchase Borders' assets for $215.1 million (in addition to assuming roughly $220 worth of liabilities).

Update from Borders: IB Times reported today that Direct Brands, a portfolio company of Najafi, will purchase Borders' assets for $215.1 million (in addition to assuming roughly $220 worth of liabilities).According to the article on IB Times Borders agreed to the deal, a "stalking horse bid," after considering two offers, and the Ann Arbor, Mich.-based company plans to seek approval from the bankruptcy court.

So who's the buyer? MarketWatch reported that Direct Brands includes Book-of-the-Month Club, Doubleday Book Clubs, Columbia House DVD and BMG Music Service. It was bought by Phoenix, Ariz.-based Najafi in 2008.

Chicago Tribune wrote that a bankruptcy court hearing on the deal is set for July 21. If the court does not approve an auction process, Borders filed a separate motion to liquidate.

What does this purchase mean for the future of Borders and the future of bookstores in general? We'll keep you posted once more information on the deal will be disclosed so stay tuned.

Yours,

Raz @ Eco-Libris

Eco-Libris: Planting trees for your books!

Wednesday, June 29, 2011

Comments on LinkedIn groups on the future of bookstores

I like to share interesting stories, both ones we write about here and others we read on the Internet, with relevant LinkedIn groups. Usually, when the story is interesting, the discussion continues in these groups and provides thoughtful and interesting comments.

I like to share interesting stories, both ones we write about here and others we read on the Internet, with relevant LinkedIn groups. Usually, when the story is interesting, the discussion continues in these groups and provides thoughtful and interesting comments. This was exactly the case with the stories on Nick Sherry's comment on the death of bookstores and the article on Toronto Star on how Indigo Books & Music is remaking itself in the age of the digital book. I wanted to share with you some of the comments these stories received on LinkedIn.

Just a reminder - Nick Sherry, the Australian minister for small businesses started an uproar after predicting that "in five years, other than a few speciality bookshops in capital cities, you will not see a bookstore. They will cease to exist because of what's happening with internet-based, web-based distribution." Our post focused on the counter-arguments to his comment, trying to figure out if they could indicate if Sherry has a point in his comment or not.

The discussion continued on the ABA LinkedIn group. Here are some of the comments:

"Hate to say it but yes. Once publisher don't need to print / wholesale books to Bookstores they won't. Borders? Barnes and Noble?. When was the last time you went to a record store?" - Michael Ridgway

"Our small independent has already gone the way of Tower Records." - Sue Barnett

" I concur with the fact that bookstores are becoming extinct; in my mind, this is the paradox that comes with technology. Will people miss the experience of physically flipping through pages of potential book purchases? Probably not, particularly since we seem to have become more and more dependent on our computers as extensions of product availability. We're not simply couch potatoes anymore, we're techno potatoe patches!" - Leamon Scott

"Well I can tell you this much, our retail and wholesale numbers are up. We do not sell ebooks. While there is definately a big change in the book business I don't believe they will become extinct. People still love the feel of a real book. " - BooksCloseOut.com

The second story came from the Toronto Sun. The story was on Indigo, the largest book retailer in Canada (Indigo also supported our 2010 Green Books Campaign) and how it is remaking itself in the digital age. The article itself is mainly an interview with Indigo CEO Heather Reisman.

Here are the comments on the LinkedIn group Digital Book World following this story, which I linked there. I have to admit that in this case the comments are more interesting than the article..

"If the US booksellers' margins are anything like Indigo's margins, traditional book retailers are doomed. $1 billion in income and only $11.3 million in profit -- that is just a little over a 1% profit margin -- zero room for error and no room for a market decline due to eBooks." - Kent Winward

"Book retail has been living on a fragile 2% or less margin since the 80s but had to weather nothing so seismic as the ebook shift, poor economy and shrinking outlets as we are today. Five years from now it will definitely be a different landscape. What worries me is in the transition we may see be some non fiction categories really suffer to the point of extinction." - Jim Fallone

"It appears Indigo is on a pair of well-financed fool's errands...

Betting the business on the Kobo reader is crazy enough - near-zero market share, and nothing compelling to recommend Kobo over the Nook, Kindle, or iPad. But aiming to become a bricks & mortar version of Amazon by selling home decor and kitchen products seems insane. " - Paul Gardner

Thanks again for all the people who contribute to these interesting discussions!

Yours,

Raz @ Eco-Libris

Eco-Libris: Planting trees for your books!

Wednesday, June 22, 2011

Barnes & Noble Bankruptcy Index: Will John Malone still be interested in B&N following their 4Q loss?

After a break of couple of weeks, we're back with our B&N bankruptcy index, following the release yesterday of B&N's fourth quarter report.

After a break of couple of weeks, we're back with our B&N bankruptcy index, following the release yesterday of B&N's fourth quarter report. Jeffrey Trachtenberg summed B&N's report on the WSJ: "Barnes & Noble Inc., the target of a takeover bid by Liberty Media Corp., saw its digital strategy pay off in its fiscal fourth quarter with healthy gains on the e-book and e-reader front, but investments in that business took a toll on the bottom line."

Still no word about the future of B&N's brick and mortar stores as B&N seems to be putting everything it got on the Nook and e-book sales, a risky bet that might be too risky for a brick and mortar company. Bottom line: This week our B&N bankruptcy index stays in the 50-59 zone: Bankruptcy is a clear and present danger.

Just a short reminder - As Borders filed for bankruptcy couple of months ago, we started looking at Barnes & Noble, the nation's largest book chain to see if they will follow Borders and also go into bankruptcy and if so, when exactly.

To do it more analytically we launched few weeks ago a new B&N Bankruptcy Index, which is based on 10 parameters, which receive a grade between 1-10 (1 - worst grade, 10 - best grade). Hence we receive a 0-100 point index scale, which we divide into several ranges as follows:

90-100: B&N is in an excellent shape. Couldn't be better!

80-89: B&N is doing great. Bankruptcy is no longer a real threat.

70-79: B&N could do better and has to be cautious of bankruptcy.

60-69: B&N doesn't look too good and bankruptcy is becoming a more realistic threat.

50-59: Bankruptcy is a clear and present danger.

49 and less: Red alert! Bankruptcy is just around the corner and is likely to happen within a short time frame.

We will check the B&N Bankruptcy Index every Thursday, updating each one of the parameters included in the index and will analyze the trend. You can follow the weekly changes in the index from the day it was launched on the Barnes and Noble Bankruptcy Index page on our website.

So here's our update for this week (in brackets is last week's grade):

1. Confidence of the stock market in B&N

This parameter will look at the performance of the B&N stock (symbol: BKS) in the last week. The performance of B&N's stock is an indication of the confidence the market has in the ability of B&N to maintain a viable business.

So let's look at last week's figures (for consistency we look at results from Wed. 6/15 to Tue. 6/21):

6/15: $19.90

6/21: $18.94

Change: -4.82%

As you can see, B&N's stock lost 4.82% last week. Just for comparison, Amazon gained 4.44% last week and the S&P500 Index went up 2.38%.

B&N's stock did well in the last couple of weeks and only fell sharply (about 6%) yesterday following the release of the 4Q report. We'll have to see how the market will digest this report and react to the relatively negative comments from analysts following the report.

This wee's grade is staying the same: 5 (5)

2. What analysts say on B&N

"Although store revenue fell, revenue from other sectors rose. Online revenue rose 54 percent to $217.3 million and college bookstore revenue rose 4 percent to $211.2 million.The revenue results show the diverging trends in book retail -- physical store sales fell while online sales rose. But the two aren't as separate as they may appear, said Simba Information senior trade analyst Michael Norris. "The physical stores are the cyclists shielding the team leader from the wind," he said. "There's no way on this planet that bn.com would have grown as much as it did without the bookstores performing as Nook showrooms for the past year." (Yahoo! Finance)

"The bookseller, which suspended its dividend this year to conserve cash, has been using its profits to invest in e-books and its Nook digital reading devices as sales of paper books falter. That helped attract interest from John Malone’s Liberty Media, which offered $17 a share for the bookseller last month. “They’re spending a huge amount of money developing a reader that people are afraid is going to go the way of the VHS tape or the CD,” Bill Kavaler, an analyst at Oscar Gruss & Son Inc. in New York, said in an interview. Kavaler recommends investors sell the shares." (Bloomberg)

"The company has had to ramp up spending on marketing on product development to stay competitive with Amazon.com Inc. (AMZN), whose Kindle is the top selling e-reader, according to Michael Souers, an analyst for Standard & Poor’s in New York. The Nook is “the only driver of long-term growth and they have to establish that niche,” said Souers, who recommends holding Barnes & Noble shares." (Bloomberg)

The market sentiment looks negative after the release of the fourth quarter report - analysts don't like the fact that B&N put all its eggs in the competitive e-book basket. Therefore our grade goes down by half a point: 5 (5.5)3. New strategy to regain sales in the brick and mortar stores

Just like Borders, B&N still doesn't have yet a clear and comprehensive strategy that will transform their brick and mortar stores from a liability back to an asset. This is also one the reasons their stores keep losing money - Sales at Barnes & Noble stores open at least one year fell by 2.9 percent in the fourth quarter, ended April 30.

Right now all they have is selling more toys and games - CEO Lynch predicted toys and games will become "a very sizeable business for us within a reasonably short time horizon." This doesn't seem to be a very viable strategy to me, as

For all of those at B&N and outside the company who think the brick and mortar stores don't matter so much, especially now when Liberty’s chairman, John Malone has indicated that his primary interest in Barnes & Noble is its Nook e-reader, I'd like to quote again here Michael Norris, an analyst of Simba Information, who said following yesterday's report:

"The physical stores are the cyclists shielding the team leader from the wind," he said. "There's no way on this planet that bn.com would have grown as much as it did without the bookstores performing as Nook showrooms for the past year." (Yahoo! Finance)

This week's grade stays the same: 3.5 (3.5)

4. What B&N is saying about itself

Barnes & Noble said yesterday it is reviewing Liberty Media’s offer, the first bid disclosed publicly since the company put itself up for sale in August. B&N said that while the offer is being considered, earnings projections for fiscal 2012 won’t be announced.

This week's grade stays the same: 6 (6)

5. Steps B&N is taking

No new steps were reported on the report. Apparently B&N won't do anything significant until it will be sold to John Malone if the bid will proceed as planned, even after the release of the 4Q results.

This week's grade stays the same: 6 (6)

6. Competitors

According to Yahoo! Finance, B&N said yesterday results were hurt by Borders' liquidation sales at 200 of its stores. Longer term, however, Barnes & Noble expects to benefit from the store closings. CFO Joseph Lombardi said in areas where a Borders store has closed, nearby Barnes & Nobles are recording revenue increases in stores open at least one year.

Also, it is reported there that "analysts have speculated over the possibility of some combination of Borders and Barnes & Noble as the industry consolidates. But Lombardi dispelled that idea. He said in a statement that over the past 5 years, before Borders filed for bankruptcy court protection, Barnes & Noble considered buying it "many times" but always came to the conclusion it wasn't interested. "We are still not interested," he said."

This week's grade stays the same: 5 (5)

7. Financial strength

Barnes & Noble released its fourth quarter report yesterday, and as the NYT wrote, it wasn’t pretty. "The company lost $59 million in the quarter, or $1.04 a share. Analysts on average had expected a smaller loss of 91 cents a share. Despite a rise in revenue, thanks to higher online and digital sales, Barnes & Noble was hurt by the liquidation of more than 200 Borders stores as part of that retailer’s bankruptcy. Sales at Barnes & Noble stores open at least one year fell by 2.9 percent in the quarter."

If you compare the results to last year's results, it doesn't look any better - B&N's net loss was $59.4 million, or $1.04 per share, for the three months ended April 30, 2011. A year ago B&N reported a net loss of $32 million, or 58 cents per share for the three months ended April 30, 2010.

This is not a good news from a financial strength perspective and therefore our grade goes does by half a point: 6 (6.5)

8. Strength of the digital business

Although store revenue fell in the fourth quarter, online revenue rose 54 percent to $217.3 million. CEO William Lynch said B&N estimates e-books added 1%-2% to its U.S. market share, bring its total to 26%-27%.

Barnes & Noble also said in its report that its Nook sales continued to improve. The company introduced a new $139 Nook last month in an effort to boost its share of the growing e-book market and also offers a NookColor for $249.

This week's grade goes up by half a point: 8.5 (8)

9. Sense of urgency

It looks like B&N still think they have time and are not worried at all, especially after they received a proposal from Liberty Media to acquire the company. They might be right because after John Malone will buy the company he's the one who will need to handle these problems. Yet, the purchase hasn't been completed yet and even if Malone will purchase the company, I'm sure it is the best interest of B&N to ensure the company reaches its next phase of operations in the best condition possible.

This week's grade stays the same: 5.5 (5.5)

10. General feeling

This parameter will be an indication of our impression of all the materials read and analyzed for this index. Our feeling that things are still not looking too good for B&N even with the offer they have from Malone - their current strategy of putting all their bets on the digital front is very risky given the fact B&N is still mainly a brick and mortar company. Yesterday's report presents this risk and its results very clearly.

This week's grade for this parameter stays the same: 5 (5)

This week's Barnes & Noble Bankruptcy Index: 55.5 points (56)

As you can see, this week's index is set at 55.5 points, which means B&N is getting deeper into the 50-59 zone: Bankruptcy is a clear and present danger. It's still not the red zone but it means that bankruptcy is getting closer and is becoming a real threat to B&N. See you next Thursday.

To view the weekly changes in the index visit Barnes and Noble Bankruptcy Index on our website.

You can find more resources on the future of bookstores on our website at www.ecolibris.net/bookstores_future.asp

Yours,

Raz @ Eco-Libris

Eco-Libris: Working to green the book industry!

Tuesday, June 21, 2011

Is Nick Sherry right about the death of bookstores within five years?

Nick Sherry, the Australian minister for small businesses started an uproar after predicting that "in five years, other than a few speciality bookshops in capital cities, you will not see a bookstore. They will cease to exist because of what's happening with internet-based, web-based distribution."

Nick Sherry, the Australian minister for small businesses started an uproar after predicting that "in five years, other than a few speciality bookshops in capital cities, you will not see a bookstore. They will cease to exist because of what's happening with internet-based, web-based distribution."His comments, as the Guardian reported, followed the collapse of Australia's largest bookseller, Angus & Robertson, and Australian high street chain Borders earlier this year. Still, Sherry got many book lovers and bookstore owners angry, but is there a chance he might be right, and as much as we hate to hear it, this is the future we're heading to?

I write here extensively about the challenges of brick and mortar bookstores and about the fact that both large retailers (B&N, Borders) and indies haven't found yet the right strategy to bring customers back to the stores. So you might guess I wasn't surprised to hear Sherry's remark. Still I was curious to see what arguments were made against his prediction as I thought they might be a good indicator whether he has a point or not.

So let's look at some of the arguments made against Sherry's prediction:

1. Joel Becker, chief executive of the Australian Booksellers Association, said he was "gobsmacked" at the "extraordinarily unhelpful" remarks, and had written to the minister asking him to explain himself. "It's an industry that's obviously going through changes, and we're responding to those changes by working out ways for even the smallest bookstores to go online and sell ebooks; we've been doing it so far without any support from the government," he told the Sydney Morning Herald.

2. Jon Page, president of the ABA and a bookseller at Sydney's Pages and Pages, insisted on Twitter that "we are not a dead or dying industry". There is "still a place for an independent that services their local community", said Page, telling the SMH that Sherry had shown "a distinct lack of understanding about the Australian book industry".

3. Daniel Jordan, managing director of Collins Booksellers, also dismissed the comment, stating: “To assume that bricks-and-mortar retailing won’t exist in five years is just plain wrong.”

4. Shadow Small Business Minister Bruce Billson also slammed Sherry’s comment, describing the minister as a “prophet of doom”. “Senator Sherry’s defeatist and demoralising commentary adds insult to the injury of his lack of support for retailing as small business adapts and innovates to respond to market trends and difficult trading conditions,” Billson said in a statement.

5. Page has had the same response in his Mosman store, and says it started in February when RedGroup Retail, the parent company of Borders and Angus and Robertson, called in administrators. ''Ever since the collapse of the RedGroup, customers have been coming into my bookshop asking if I am going to close, too,'' he told me yesterday. ''The minister's comments have been very damaging because they have reinforced in some customers' minds the idea that bookshops are on the way out.''

Bottom line: Let's not shoot the messenger. It won't help the future of bookstores even a bit.

Yours,

Raz @ Eco-Libris

Saturday, May 14, 2011

Barnes & Noble Bankruptcy Index: Borders may have a buyer while B&N put all their eggs in one e-nest

Sorry for the two day delay, but we're here with the weekly update on the B&N bankruptcy index. This week the stock continues to go up, probably still because of B&N's plans to introduce a new e-reader later on this month.

Sorry for the two day delay, but we're here with the weekly update on the B&N bankruptcy index. This week the stock continues to go up, probably still because of B&N's plans to introduce a new e-reader later on this month.Still no word about the future of B&N's brick and mortar stores as B&N seems to be putting everything it got on the Nook and e-book sales, a risky bet that might be too risky for a brick and mortar company. Bottom line: This week our B&N bankruptcy index stays in the 50-59 zone: Bankruptcy is a clear and present danger.

Just a short reminder - As Borders filed for bankruptcy couple of months ago, we started looking at Barnes & Noble, the nation's largest book chain to see if they will follow Borders and also go into bankruptcy and if so, when exactly.

To do it more analytically we launched few weeks ago a new B&N Bankruptcy Index, which is based on 10 parameters, which receive a grade between 1-10 (1 - worst grade, 10 - best grade). Hence we receive a 0-100 point index scale, which we divide into several ranges as follows:

90-100: B&N is in an excellent shape. Couldn't be better!

80-89: B&N is doing great. Bankruptcy is no longer a real threat.

70-79: B&N could do better and has to be cautious of bankruptcy.

60-69: B&N doesn't look too good and bankruptcy is becoming a more realistic threat.

50-59: Bankruptcy is a clear and present danger.

49 and less: Red alert! Bankruptcy is just around the corner and is likely to happen within a short time frame.

We will check the B&N Bankruptcy Index every Thursday, updating each one of the parameters included in the index and will analyze the trend. You can follow the weekly changes in the index from the day it was launched on the Barnes and Noble Bankruptcy Index page on our website.

So here's our update for this week (in brackets is last week's grade):

1. Confidence of the stock market in B&N

This parameter will look at the performance of the B&N stock (symbol: BKS) in the last week. The performance of B&N's stock is an indication of the confidence the market has in the ability of B&N to maintain a viable business.

So let's look at last week's figures (for consistency we look at results from Wed. 5/4 to Wed. 5/11):

5/4: $12.01

5/11: $13.46

Change: +12.1%

As you can see, B&N's stock went up in 12.1%. Just for comparison, Amazon went up 2.2% last week and the S&P500 Index lost 0.4%.

I believe the stock is going up this week because of the same reason it went up last week - the excitement from the news on B&N's upcoming announcement (on May 24) on the launch of a new electronic book reader.

StreetAuthority thinks it's also all about the Nook:

Back in March, I suggested "the odds are increasing for a convincing turnaround." My logic rested on two pillars: First, a massive shrinkage in the store base of rival Border's would help drop-in traffic in those neighborhoods affected. Second, the company's Nook electronic reading device was starting to emerge as a real contender among the small group of e-readers. As it turns out, it's the Nook that explains why shares of Barnes & Noble have taken off like a rocket, rising 50% in less than a month. (Seeking Alpha)

So it looks like the stock jumped only because of the news on the upcoming e-reader, but since this trend is already going on for two weeks and gaining some sort of momentum, this wee's grade is going up in half a point: 5 (4.5)

2. What analysts say on B&N

Katie Spence still doesn't believe in B&N:I'm not giving up my books just yet. There is something about the smell and texture of an actual book that simply can't be replicated by e-books. That said, the future of the brick-and-mortar Barnes & Noble looks bleak. With companies such as Amazon dominating in sales, both in e-books and paperback, the time of bookselling superstores is gone. (The Motley Fool)

Spence sees that B&N is putting all her money and efforts into the Nook and ebook sales and she's wondering "are the Nook and e-book sales enough to keep Barnes & Noble afloat?" That's a good question - B&N is taking a very risky gamble here, leaving the stores, which are still its core business, out of the picture.

We don't see a significant change in the market sentiment and therefore our grade stays the same: 5.5 (5.5)

3. New strategy to regain sales in the brick and mortar stores

Just like Borders, B&N still doesn't have yet a clear and comprehensive strategy that will transform their brick and mortar stores from a liability back to an asset.

4. What B&N is saying about itself

We didn't find any quotes this week. Our grade for this parameter stays the same: 6 (6)

5. Steps B&N is taking

One interesting step we learned about from the WSJ was B&N's offer to Borders to buy 10 stores, along with the company's website and customer lists. Borders refused to the offer according to the article. This week's grade stays the same: 6 (6)

6. Competitors

This parameter will mainly look into Borders and how its problems affect B&N. WSJ reported earlier that "Borders Group Inc. is in discussions with a potential bidder for more than 225 stores that would keep the bookstore chain operating as a going concern, said people familiar with the matter. " Still it's not clear if Borders can find a buyer to the whole business, as according to Bloomberg "No Bidder Said to Be Found to Buy All of Borders." We'll have to wait though and see if it such a deal will actually happen or not and what it will include before we change the grade. Therefore this week's grade stays the same: 5 (5)

7. Financial strength

Katie Spence mentions in a comment she made to her article that "if you look at B&N's long term debt you will notice that it is currently at $260.4 million where as previously it was at 0. Additionally, its total current liabilities exceeds it total current assets and that is with a change in its annual reporting date (usually a bad sign for any company). All in all, the signs are looking bad for the brick-and-mortar company."

This is not a good news from a financial strength perspective and therefore our grade goes does by half a point: 6.5 (7)

8. Strength of the digital business

Nothing much happened on this front. This week's grade stays the same: 8 (8)

9. Sense of urgency

It looks like B&N still think they have time and are not worried at all, or at least not worried enough to begin doing something with their brick and mortar stores (again, we don't believe more toys in the stores and extra room for the Nook is a winning strategy). If we can learn something from the Borders' case, it's how fast things go bad when your reach a certain tipping point of financial distress or distrust of your stakeholders (consumers or publishers for example). This week's grade stays the same: 5.5 (5.5)

10. General feeling

This parameter will be an indication of our impression of all the materials read and analyzed for this index. Our feeling that things are still not looking too good for B&N hasn't changed this week and actually we feel that somehow the company is a bit lost when it comes to find how to generate more sales in its brick and mortar stores. This week's grade for this parameter stays the same: 5 (5)

This week's Barnes & Noble Bankruptcy Index: 56 points (56)

As you can see, this week's index is set at 56 points, which means B&N is getting deeper into the 50-59 zone: Bankruptcy is a clear and present danger. It's still not the red zone but it means that bankruptcy is getting closer and is becoming a real threat to B&N. See you next Thursday.

To view the weekly changes in the index visit Barnes and Noble Bankruptcy Index on our website.

To view the weekly changes in the index visit Barnes and Noble Bankruptcy Index on our website.You can find more resources on the future of bookstores on our website at www.ecolibris.net/bookstores_future.asp

Yours,

Raz @ Eco-Libris

Eco-Libris: Working to green the book industry!